The 10-Second Trick For Offshore Account

Table of ContentsThe 8-Second Trick For Offshore AccountOffshore Account Things To Know Before You BuyThe Facts About Offshore Account UncoveredWhat Does Offshore Account Do?

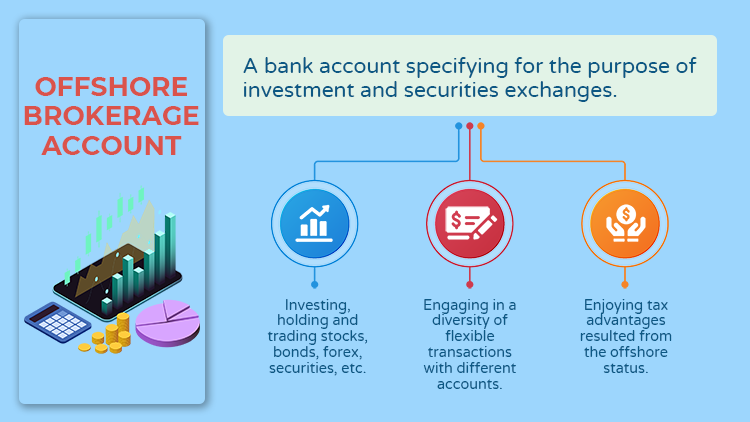

Two common misconceptions about overseas financial are that it is illegal which it is just for the super-wealthy. Well, it's not fairly so. As a deportee you can make use of overseas financial legally and also to your benefit. This overview will certainly show you exactly how. Banking offshore in a nation other than the one in which you presently live is absolutely lawful as well as legitimate.An overseas checking account is frequently utilized by those who have little confidence in their regional financial sector or economy, those who live in a much less politically stable nation, those that can legally stay clear of taxation in their brand-new nation by not paying funds to it, and also expats that want one centralised checking account resource for their worldwide monetary demands.

Maintaining a checking account in a nation of residence makes considerable and also long-lasting feeling for several migrants. Unless you're attempting to alter your country of residence as well as cut all connections with your house country forever, keeping a financial presence there will certainly mean that if ever before you desire to repatriate, the path will certainly be smoother for you.

For instance, your employer may require you have such an account into which your income can be paid each month. You might additionally need such an account to have actually energies attached to your brand-new residential property, to obtain a mobile phone, lease a house, increase a home loan or purchase an automobile.

Offshore Account - The Facts

The main point to bear in mind is that overseas banking isn't always a best option for each expat. It is essential to know what benefits and also drawbacks offshore banking has and also how it fits in your individual situation. To aid you determine whether an overseas savings account is best for you, right here are the most popular benefits and downsides of offshore financial.

If the nation in which you live has a less than favourable economic environment, by maintaining your wealth in an overseas savings account you can prevent the threats in your brand-new country such as high inflation, money decrease or perhaps a coup or war. For those deportees staying in a country where you only pay tax accurate you remit right into that nation, there is an obvious tax obligation advantage to maintaining your cash in an offshore savings account.

Expats can gain from this despite where they are in the world as it can indicate they can access their funds from Atm machines or online or over the phone any time of the day or night, regardless of what the time zone. Any passion gained is typically paid devoid of the deduction of taxation.

Some Of Offshore Account

Keep in mind: expert estate planning suggestions requires to be sought by anyone seeking to profit from such an advantage. Some overseas banks charge much less and some pay more rate of interest than onshore financial institutions. This is ending up being much less and also much less the instance nowadays, but it deserves looking closely at what's offered when looking for to establish a brand-new offshore bank account. offshore account.

Much less government treatment in offshore monetary centres can imply that offshore banks are able to offer even more interesting investment solutions as well as options to their customers. You may take advantage of having a connection manager or exclusive checking account manager if you pick a premier a knockout post or private overseas savings account. Such a service is of benefit to those who want a more hands-on approach to their account's management from their financial institution.

and permit you to wait on a certain rate prior to making the transfer. Historically financial offshore is probably riskier than financial onshore. This is shown when taking a look at the fallout from the Kaupthing Singer and Friedlander collapse on the Island of Guy. Those onshore in the UK who were impacted locally by the nationalisation of the bank's parent business in Iceland received complete compensation.

The term 'offshore' has actually come to be identified with prohibited and immoral cash laundering as well as tax evasion task. As a result possibly any person with an overseas bank account can be find out here now tarred, by some, with the exact same brush despite the fact that their offshore banking activity is completely genuine (offshore account). You need to choose your offshore territory meticulously.

More About Offshore Account

It's essential to look at the terms as well as problems of an overseas financial institution account. It can be a lot more challenging to settle any type of concerns that may occur with your account if you hold it offshore.

We hope this open as well as ever-developing checklist of the advantages as well as negative aspects of offshore banking will help you to compose your very own mind regarding whether or not an overseas savings account is ideal for you. The Expat Guide to UK Pensions Abroad what options you have for your UK pension pot when you retire abroad, tax effects of leaving your pension plan in the UK or transferring it abroad, how you can decrease your tax responsibilities, your UK state pension plan, etc.Expat Financial Questions Answered By An Expert Wide Range Manager FAQs regarding transferring to Europe after Brexit: your tax obligation commitments, money i loved this issues, pension alternatives, will, estate planning, savings and investments, and also, more.Offshore Portfolio Bonds Explained what you need to recognize regarding offshore profile bonds prior to considering them as a financial investment option.Banking, Saving, & Investments Abroad your banking as well as financial investment options broaden when you become an expat. And in addition to abiding with these robust criteria, deportees may still be able toenjoy even more personal privacy from an overseas bank than they can from an onshore one. Around the clock aid if something fails, with accessibility to telephone as well as electronic banking 24 hr a day, 7 days a week, 365 days of the year -typically come as standard - offshore account. This factor alone is enough for many individuals to open up an offshore bank account. There can be expat tax obligation advantages to utilizing an offshore bank -but whether these use in your instance will certainly depend upon your personal situations, such as country of residence. Some account owners who financial institution in jurisdictions like the Island of Man and Jacket, for example, can choose to obtain interest on their cost savings tax free. As an expat, this eliminates the demand to reclaim tax paid, as well as avoids the headache of resolving your tax obligation returns to guarantee you are not over-paying tax obligation.